Crypto Payments For Freelancers: Quick Start Guide [2024]

![Crypto Payments For Freelancers: Quick Start Guide [2024]](/content/images/size/w1200/2024/03/Copy-of-Copy-of-Top-Digital-Products-to-sell-for-Bitcoin.png)

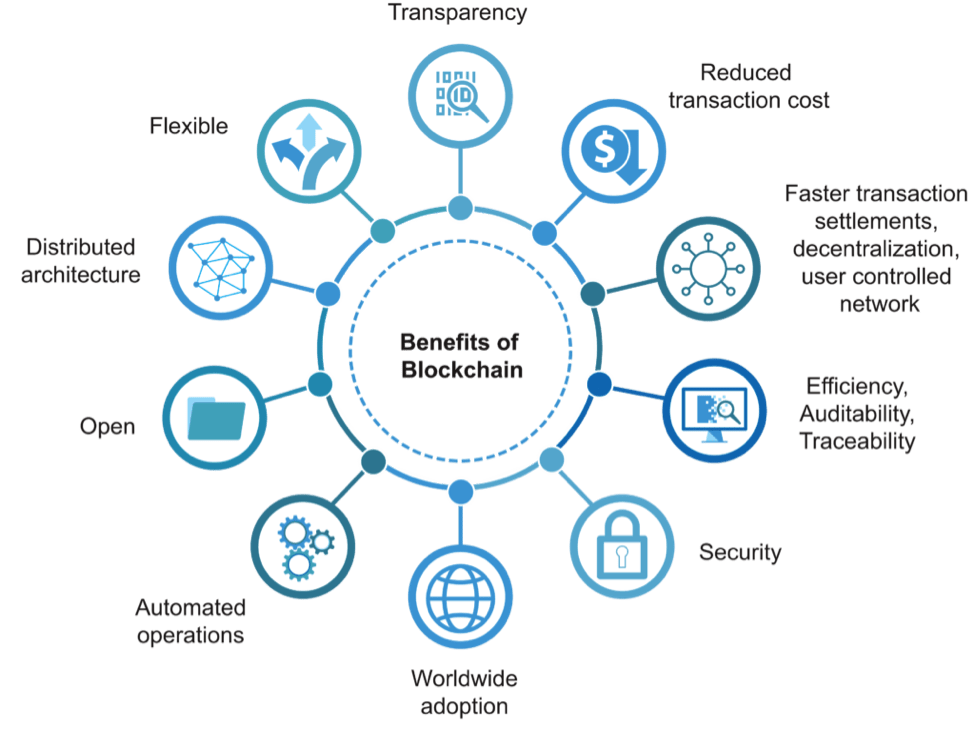

Freelancers, individuals who offer their services on a contractual basis, have long faced challenges when it comes to receiving payments. Traditional payment methods, such as bank transfers and checks, often entail high fees, long processing times, and bureaucratic hurdles. Moreover, in an increasingly globalized economy, freelancers frequently encounter difficulties with cross-border transactions, including currency conversion fees and exchange rate fluctuations.

Enter cryptocurrencies – digital assets that operate on decentralized networks powered by blockchain technology. Cryptocurrencies offer several advantages over traditional payment methods, making them an attractive option for freelancers worldwide.

Instant Transactions:

One of the most significant benefits of crypto payments for freelancers is the speed of transactions. Unlike traditional banking systems, which may take days to process payments, cryptocurrency transactions occur almost instantaneously or at the latest in a few hours.

This rapid settlement enables freelancers to access their funds immediately, improving cash flow and streamlining their business operations.

Lower Fees:

Traditional payment processors often levy substantial fees on transactions, eating into freelancers' earnings. In contrast, cryptocurrency transactions typically involve lower fees, particularly for cross-border payments. You have to navigate currency conversion, transaction fees,

Since cryptocurrencies operate on decentralized networks without intermediaries, there are fewer overhead costs associated with processing transactions. As a result, freelancers can retain more of their earnings when accepting payments in cryptocurrency.

Borderless Payments:

For freelancers who work with clients from around the globe, cryptocurrency payments offer a borderless solution. Unlike traditional currencies, which are subject to geopolitical boundaries and regulatory restrictions, cryptocurrencies can be sent and received across borders seamlessly. This borderless nature eliminates the need for expensive international wire transfers and mitigates the risk of currency conversion fees and fluctuations.

Enhanced Security:

Security is paramount in the world of freelancing, where sensitive financial information is exchanged regularly. Cryptocurrency transactions are secured using cryptographic techniques and distributed ledger technology, making them inherently resistant to fraud and tampering.

Additionally, cryptocurrencies empower freelancers to take control of their financial data, reducing the risk of identity theft and unauthorized access.

Financial Inclusion:

Cryptocurrencies have the potential to foster financial inclusion by providing access to financial services for individuals who are underserved or excluded by traditional banking systems. Freelancers in developing countries, where access to banking services may be limited, can benefit greatly from the accessibility and ease of use offered by cryptocurrencies. By embracing crypto payments, freelancers can participate more fully in the global economy and overcome barriers to financial inclusion.

Implementing Crypto Payments

While the advantages of crypto payments for freelancers are plenty what's even better is implementing them effectively. With a pretty straightforward process and quick setup, to accept payments in crypto freelancers have 2 main options:

- Invoice

- Payment Button/Links

Invoice

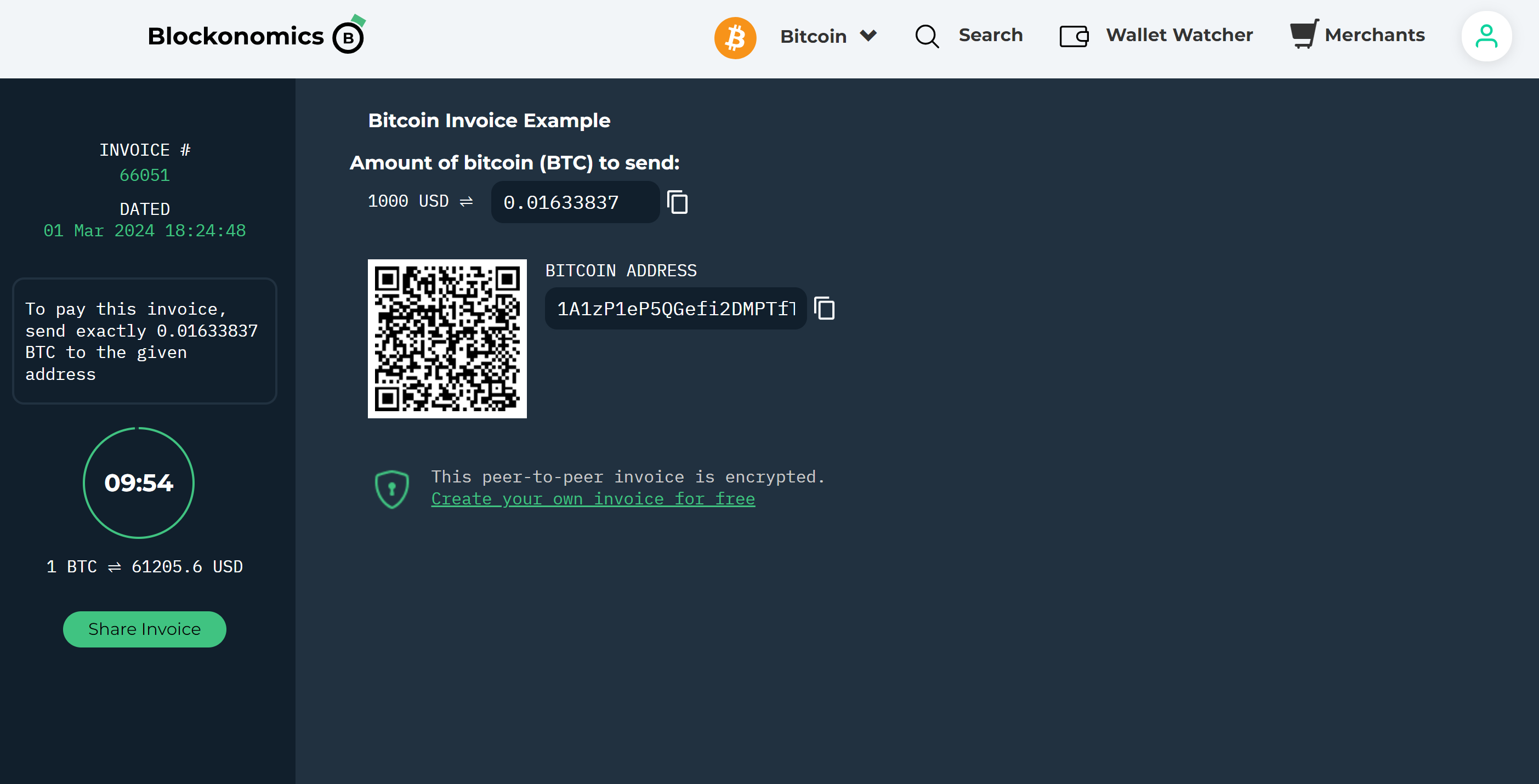

The most common and convenient method to accept payments is crypto. Crypto invoicing works in a similar fashion to fiat invoices. It contains details of your work along with crypto payment details where the payment needs to be made.

A crypto invoice can look something like this:

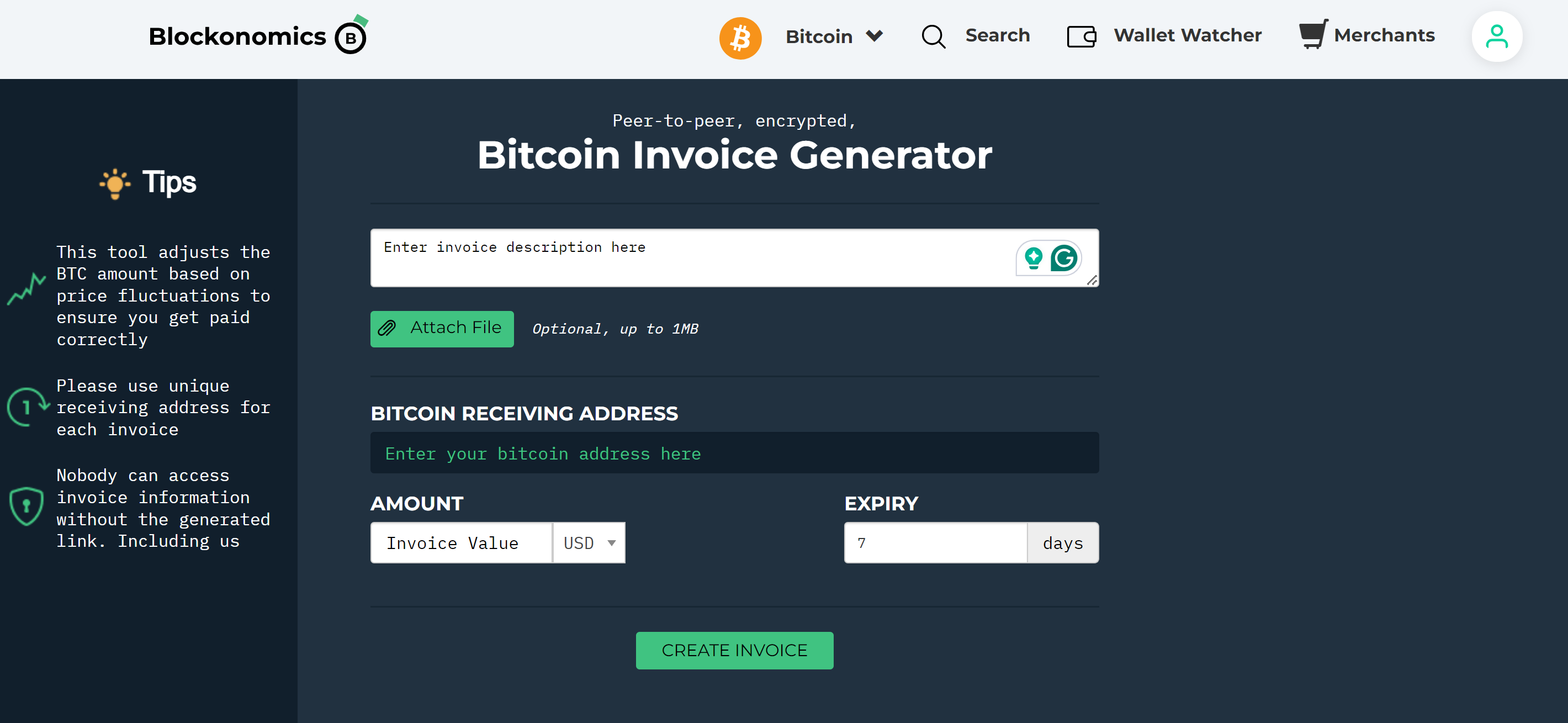

[Step A] To create a crypto invoice, all you have to do is head over to Blockonomics Invoice

[Step B] Enter

- Invoice Description, this could include details of your work.

- Amount in your desired currency (the invoice automatically converts the amount into relevant BTC amount based on the conversion)

- Your Bitcoin Address where you wish to receive the payment

[Step C] 'Create Invoice' and share the link with your client.

Bitcoin Invoice Link Example: https://www.blockonomics.co/invoice/66051/#/?key=UVLbIHSa

Things to Consider:

- If you wish to invoice in a different cryptocurrency than BTC then consider using services like Request Finance, NowPayments, and Gilded. Please note you might incur a fee while using these services.

- Use a safe crypto wallet to receive funds whose private keys are owned by you.

- Consider converting your crypto to stablecoins or fiat if you are concerned about price fluctuations or volatility.

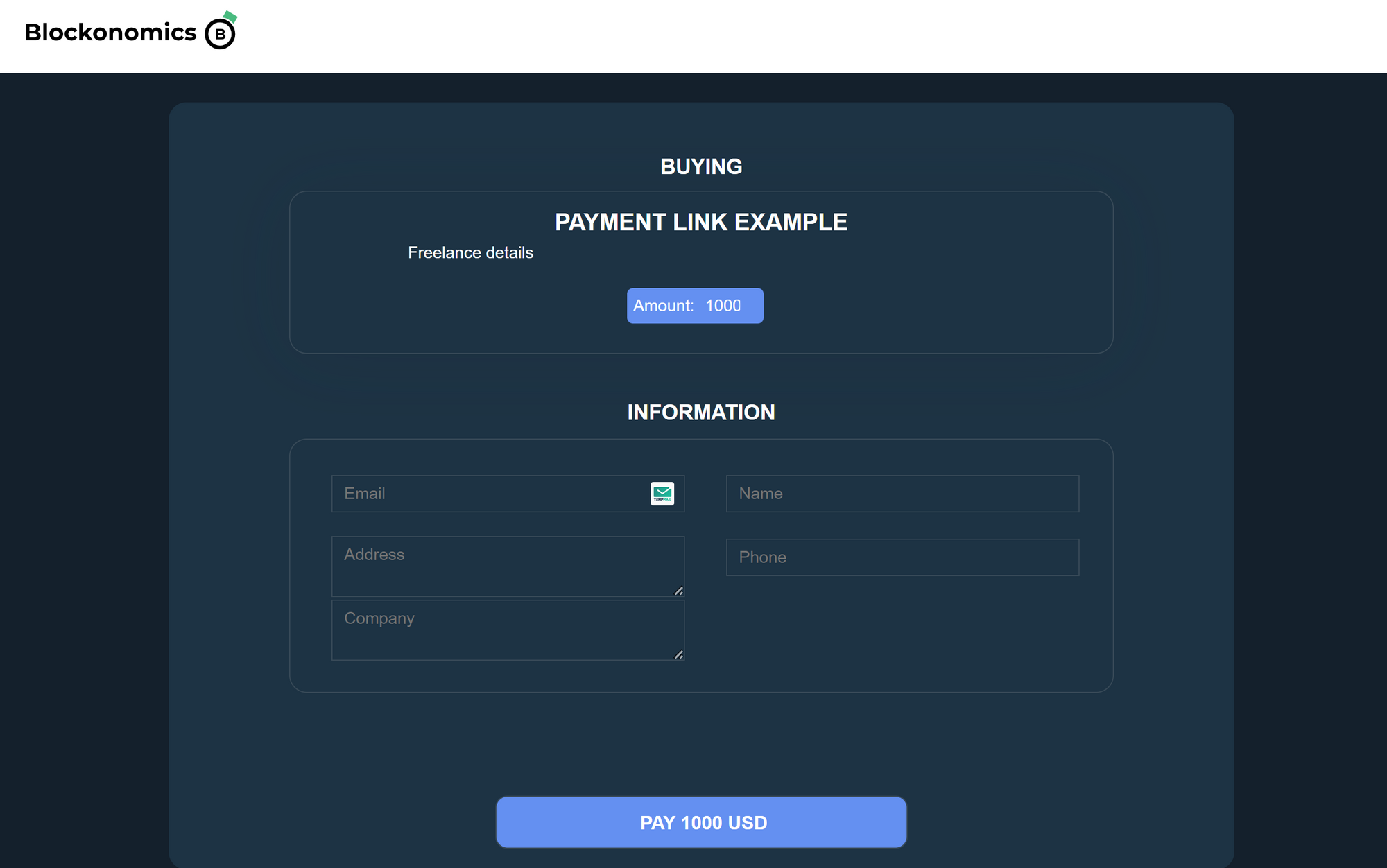

Payment Links

Payment Links is another innovative solution for freelancers to receive payments for their services. Payment links are standalone checkout pages with payment details allowing you to receive Bitcoin payments easily.

A payment link can be shared easily with your clients online, even as a text message. The advantage of these payment links is that they can be created once and used for as many clients and as many times as you want as they don't expire.

Payment Link Example: https://www.blockonomics.co/pay-url/40bbd3f80fe9446b

[Step A] Head over to Blockonomics Merchants. Either log-in or sign-up for an account.

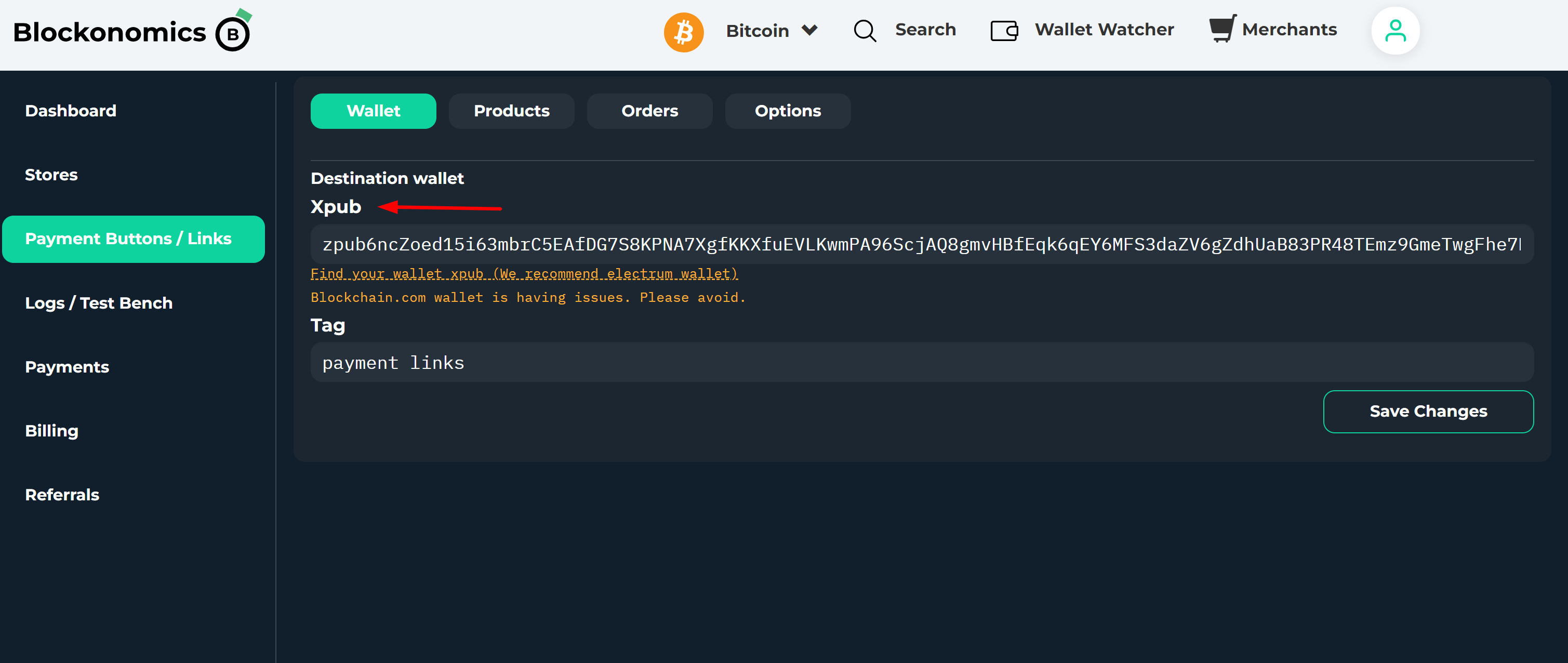

[Step 2] Click on Payments Buttons and enter the details of your receiving wallet.

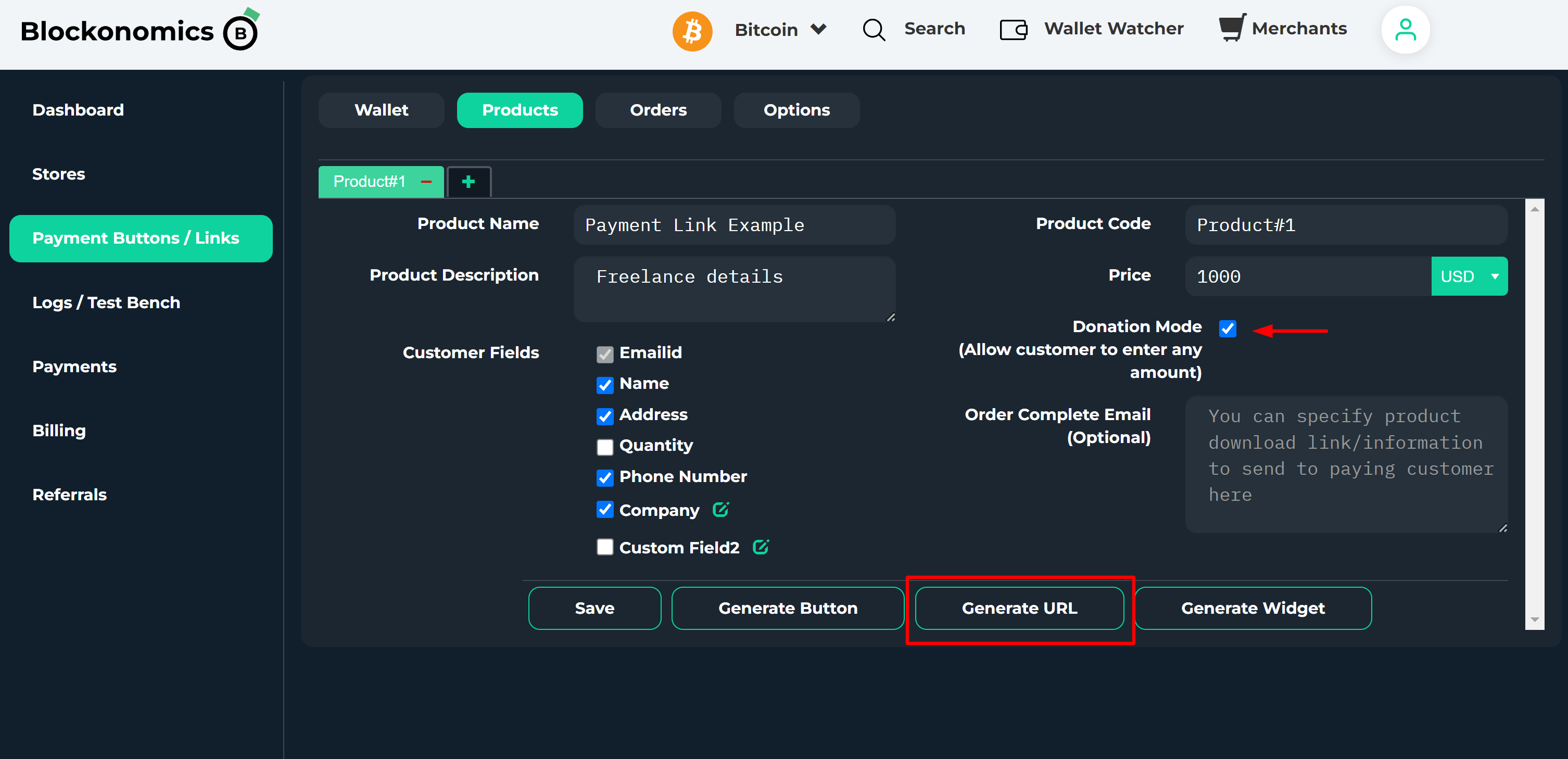

[Step 3] Then click on the 'Products' tab and enter the details of your payments. You can ask for the name, company, and email address of the payee to distinguish between different clients.

Tip: Make sure to check the 'Donation Mode' option if you wish to keep the receiving amount dynamic.

[Step 4] Hit 'Generate URL' and share the link.

Things to Consider:

- Payment links are great if you have a fixed recurring amount that needs to be paid by one or multiple clients.

- If your amount is dynamic then you have to trust the client puts in the right amount each time. Also, it would have to be communicated separately.

- If you wish to use a different cryptocurrency than BTC then consider using services like BoomFi, and xMoney. Please note you might incur a fee while using these services.

- Use a safe crypto wallet to receive funds whose private keys are owned by you.

- Consider converting your crypto to stablecoins or fiat if you are concerned about price fluctuations or volatility.

Best Practices

A. Choose the Right Cryptocurrency:

With thousands of cryptocurrencies available, freelancers must select the right one for their needs. Bitcoin, Ethereum, and Litecoin are among the most popular options, offering widespread acceptance and liquidity.

However, freelancers should also consider factors such as transaction fees, transaction speed, and the stability of the cryptocurrency's value. If volatility is an issue then consider accepting stablecoins such as USDT, on the other hand, if transaction fee is an issue then consider Litecoin or BCH.

B. Set Up a Digital Wallet:

To send and receive cryptocurrency payments, freelancers need to set up a digital wallet – a software or hardware-based solution that stores their crypto assets securely. There are various types of wallets available, including online wallets, mobile wallets, desktop wallets, and hardware wallets.

In terms of security for the type of wallets, the classification is something like this:

[Most] Hardware > Desktop > Mobile > Web [Least]

Freelancers should choose a wallet that aligns with their security preferences and usability requirements.

C. Communicate with Clients:

Effective communication is essential when transitioning to crypto payments. Freelancers should inform their clients of their preferred payment method and provide guidance on how to initiate cryptocurrency transactions.

Clear communication can help alleviate any concerns or questions clients may have and facilitate a smooth transition to crypto payments.

D. Monitor Regulatory Developments:

Cryptocurrency regulations vary significantly from one jurisdiction to another and are subject to ongoing changes and developments. Freelancers should stay informed about the regulatory landscape in their respective countries and comply with any applicable laws or reporting requirements related to crypto transactions. Engaging legal and financial professionals with expertise in cryptocurrency regulation can help freelancers navigate this complex environment effectively.

Conclusion:

Cryptocurrency payments have the potential to revolutionize the way freelancers transact, offering benefits such as instant transactions, lower fees, borderless payments, enhanced security, and financial inclusion.

By embracing crypto payments, freelancers can streamline their business operations, access a global customer base, and retain more of their earnings. While implementing crypto payments requires careful planning and consideration, the long-term advantages for freelancers are undeniable. I am excited to see how cryptocurrencies continue to empower freelancers and reshape the future of work.

FAQs

Why should freelancers consider accepting crypto payments?

Accepting crypto payments can offer several benefits, including lower transaction fees, faster cross-border transactions, increased privacy, and the potential for investment appreciation.

What cryptocurrencies can freelancers accept?

You can accept almost any cryptocurrency you wish as long as the client is willing to pay you in it. Popular ones include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and many others. It's essential to choose cryptocurrencies based on factors such as popularity, stability, and ease of conversion to fiat currency.

How do freelancers convert crypto to fiat currency?

You can convert crypto to fiat currency through various cryptocurrency exchanges or peer-to-peer platforms. You can then transfer the converted fiat currency to their bank account.

Do freelancers need to pay taxes on crypto payments?

Tax regulations regarding cryptocurrencies vary by jurisdiction. You should consult with tax professionals to understand their tax obligations regarding crypto payments, including income tax, capital gains tax, and reporting requirements.

What precautions should freelancers take when accepting crypto payments?

You should verify the identity of clients, ensure payment addresses are accurate, and confirm transactions. You should also be aware of the potential for cryptocurrency price volatility and adjust pricing or conversion strategies accordingly.

Can freelancers offer discounts for crypto payments?

Offering discounts for crypto payments can incentivize clients to pay with digital currencies. You can adjust your pricing structure to reflect potential savings from lower transaction fees or faster transactions associated with crypto payments.

Comments ()