Cryptocurrency, Venezuela, and the International Order

Cryptocurrency has the possibility to upset the International Order. Just take a look at Venezuela and its state-backed cryptocurrency For many, cryptocurrency represents freedom from the shackles of government and financial institutions. It allows financial transactions to be performed without the

For many, cryptocurrency represents freedom from the shackles of government and financial institutions. It allows financial transactions to be performed without the ever seeing eye of big brother, thanks to its anonymity and decentralized nature. Yet, governments also see their own benefits in using cryptocurrencies. Venezuela is the most prominent attempt at state used cryptocurrency, and while at first glance it appears to have been a complete farce plagued with incompetency, the implications to the international system is major.

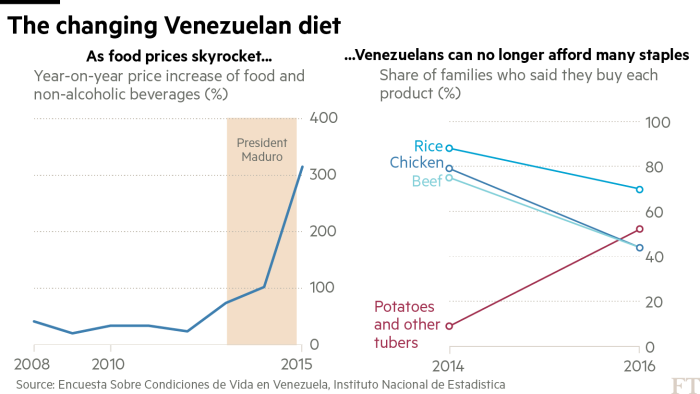

Petro was launched this February by the Venezuelan government on the NEM blockchain. Venezuela’s fiat currency has been afflicted by hyperinflation for the past few years. This combined with the 2013 death of the charismatic former leader, Hugo Chavez, who’s policies started the hyperinflation, has exemplified the ongoing US economic sanctions against the country. Desperate to alleviate the worsening situation, the Venezuelan government decided to look into developing its own cryptocurrencies. The roll out seemed rocky; it has gained little to no international recognition, the US and others are not allowing banks to process purchases of Petro, and a variety of organizations, both Crypto and otherwise, have deemed it a scam.

However, the larger implications, and the currency itself, shouldn’t be written off too quickly. Russia’s involvement in the Petro’s development is the first warning bell. Despite Russian claims that there was no involvment, a Time Magazine investigation discovered that a variety of Russian businessmen and officials had major roles in developing the currency. In fact, the only international financial institution which has defied US sanctions to allow direct purchase of Petros is a bank in Moscow.

Russia’s involvement shows how cryptocurrencies might give international leaders a headache. Russia, who is also the target of sanctions by the US and Europe, has obviously been using Venezuela as a guinea pig. Venezuela is cash strapped, and cryptocurrency offers an easy way for the government to gain international fiat. Russia has been investigating ways to circumvent the West’s sanctions, and crypto could be the answer. Although the Petro’s roll out was shaky, there are two important things to remember when examining its effect.

First, Maduro, Venezuela’s President, has claimed the Petro has been a success. He claims millions of dollars has been acquired by the government through sales to various entities and people around the world. Now, claims like these should be taken with a grain of salt. However, Maduro is still going through with his plan to have the Petro being accepted for all government functions, including taxes, and has been pushing for private businesses to accept the coin. If the Petro could be massively adopted by the population, many of whom already use Bitcoin for day to day purchases, it could be a big step for stability. However, the Venezuelan people don’t trust the government, so that seems unlikely.

Second, if the currency is even a minor success, it could serve a blueprint for other states under sanctions, namely Russia. Venezuela’s infrastructure and international standing is currently weak, so the Petro already had a lot stacked against it. However, if Russia can learn from the mistakes regarding the Petro, a Russian state-backed cryptocurrency could be quite successful. Using Venezuela as a guinea pig, other nations can easily develop state-backed cryptocurrencies that address the problems the Petro has. This could spell doom for the Western dominated international system. If pariah states can raise international funds by creating cryptocurrencies, already weak international sanctions could be found worthless.

This would cause major upheaval in the international system. Sanctions often work in getting states to a negotiating table, whether its Iran or North Korea. However, if these states can find it easier to maintain their regimes or nuclear programs and still have the ability to bypass international sanctions they would take it.

The Petro seems destined to fail, mainly because it has been rejected by the majority of the world, both in crypto-communities and outside. However, it can easily serve as a dangerous precedent for future state-backed cryptocurrencies. If other pariah states can develop upon the Petro, international sanctions could become useless. Additionally, it would play into the hands of those against cryptocurrencies, by allowing them to capitalize upon the meme that cryptocurrency is only used by criminals for nefarious means. Petro’s legacy could be dangerous for both the international system and the cryptocurrency community.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments (0)