How To Integrate Blockonomics With CoinLedger

Key steps to help you stay compliant as well as how Blockonomics merchants can easily calculate their taxes and generate reports with CoinLedger.

In the ever-evolving world of cryptocurrencies, staying on top of your financial responsibilities is crucial. One such responsibility that often perplexes crypto enthusiasts is tax filing. As governments around the world catch up with the rise of digital assets, it's essential to understand how to navigate the crypto tax maze.

Blockonomics has partnered with CoinLedger, a leading crypto tax software to provide its merchants with an easy and quick way to calculate their taxes.

In this comprehensive guide, we'll look at how Blockonomics merchants can easily calculate their taxes and generate reports with CoinLedger.

How To Calculate Your Crypto Tax For Blockonomics Transactions?

To calculate your crypto taxes for your blockonomics transactions you will need to export your transactions from your account which will give you a detailed list of your transactions along with the fiat value at the time of transaction.

You can use this export to calculate your crypto tax liabilities either manually or using specialized software. Given the high volume and the complexity involving calculating taxes, it is highly recommended that you choose the latter option.

For Blockonomics, the easiest way is to use CoinLedger, a crypto tax platform that automates your reporting efforts by calculating your crypto tax liabilities as well as tax forms based on your jurisdiction.

As a special perk, Blockonomics Merchants get to enjoy a 10% discount if they sign up on CoinLedger and sign up for any of their paid plans.

Simply sign up using this link to avail the discount!

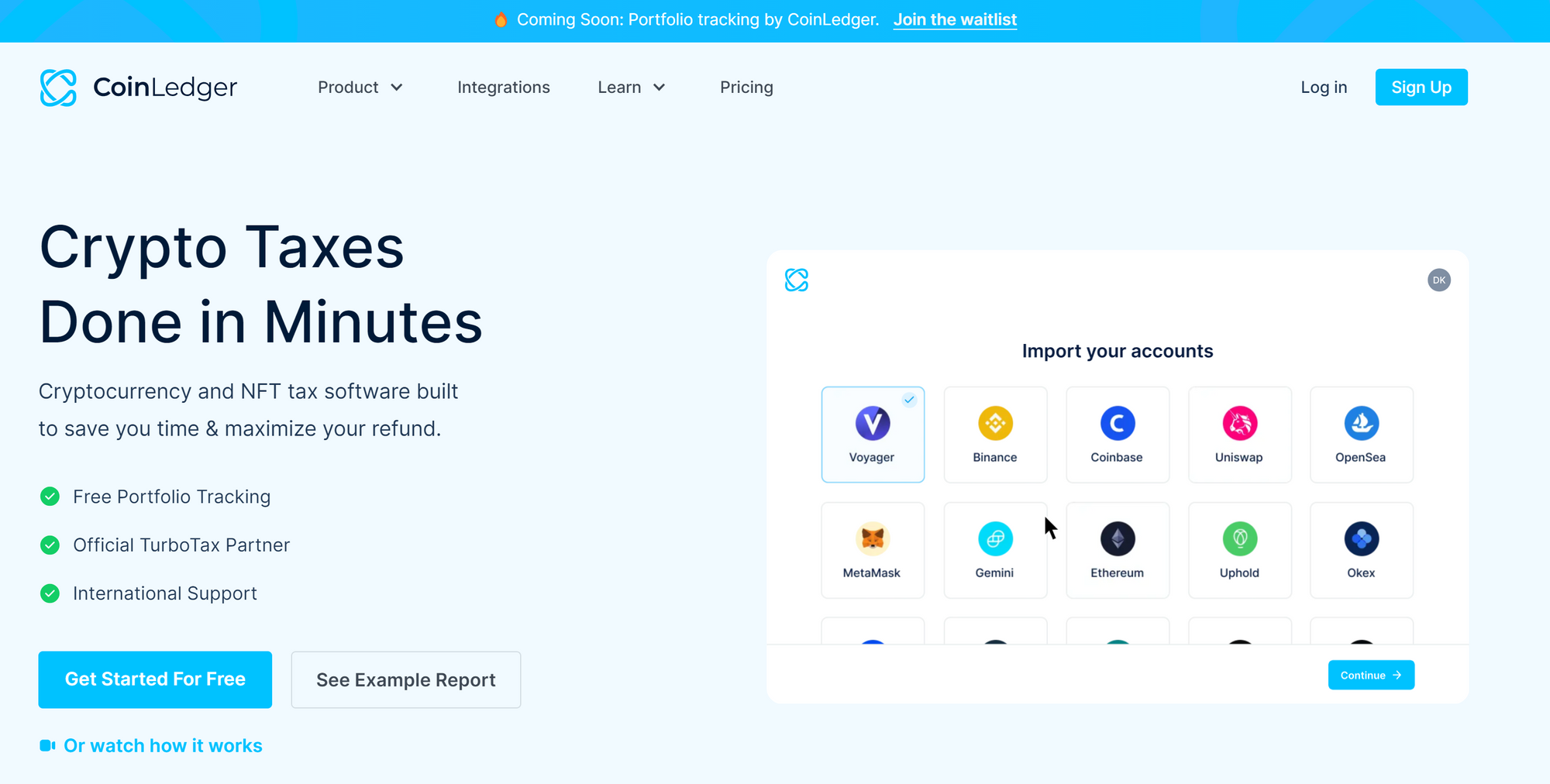

What is CoinLedger?

CoinLedger is a cryptocurrency and NFT tax platform that is built to save you time & maximize your refund. You can easily import all your crypto transactions onto the platform and it automatically calculates your taxes and generates tax reports.

Additionally, it even helps you save up on tax bills by calculating your losses [subject to jurisdiction].

CoinLedger is a free-to-use platform but if you wish to generate tax reports you will have to sign up for a paid plan. Check out more about their pricing here.

To avail a 10% discount as a Blockonomics Merchant sign up using this link.

You can integrate almost every crypto platform with CoinLedger which means that your entire crypto portfolio will be used to calculate your taxes keeping you compliant and up to date.

CoinLedger also offers a free portfolio tracker and a library of educational articles, videos, and eBooks on crypto tools and taxes.

How To Import Your Crypto Transaction To Coinleger From Blockonomics

Step 1: Export Transactions from Blockonomics Account

Head to the Blockonomics site and log into your Blockonomics Account.

Once you've logged in, select Wallet Watcher at the top of the screen and the Export option from the side tab.

Select the date range for your export. Be sure to select as wide of a date range as possible to ensure that CoinLedger has an accurate picture of your transaction history.

Additionally, be sure to check “Show fiat value at time of transaction”.

Then, click Export to CSV to generate and download your file.

Important: Make sure that you select the CSV file option and not the Excel file option.

Step 2: Integrate Blockonomics Into CoinLedger

Head over to CoinLedger and Log-in/Sign-Up to your CoinLedger account.

Once successfully logged in, add a Blockonomics account by clicking Add Account and searching for Blockonomics.

Step 3: Upload Your Transactions

Click on Upload File and drag your Blockonomics CSV file(s) you downloaded before into the box to seamlessly import your transactions.

Each of your transactions will now be imported.

Conclusion:

Navigating the crypto tax maze may seem daunting, but with careful planning and attention to detail, you can fulfill your tax obligations successfully. Educate yourself, keep detailed records, and stay updated on regulatory changes to ensure compliance.

Using CoinLedger for Blockonomics can significantly reduce your overhead and automate your tax process. By taking a proactive approach to crypto taxation, you can navigate the complexities and continue to enjoy the benefits of participating in the exciting world of cryptocurrencies.

FAQs

What is the tax rate for cryptocurrency and other virtual assets?

The tax rate on virtual currency varies by the jurisdiction where you are filing your taxes. Each of them has its own set of rules and tax slabs for virtual currency. Plus it also depends on how you got it and how you used it.

In the USA, tax rates on crypto can range between 10% to 37% for short-term capital gains, while long-term gains can accrue at a rate of 0%, 15%, or 20%. Take a look at how to manage your Bitcoin taxes in the USA.

In India, there is a flat 30% tax on gains from all virtual assets, while payments in crypto are taxed at nominal fiat rates which can range from 0% to 30% depending on the annual value.

What is considered taxable vs non-taxable crypto transactions?

Gains made from cryptocurrency plus payments received in the form of crypto are usually considered taxable. But it all comes down to how to use your crypto, there are a lot of things that can be done with crypto such as mining, airdrops, trading, investments, payments, staking, yield farming, and NFTs to name a few. You have to make sure the check the rules for how these different activities are taxed.

But again this is subject to individual jurisdictions who set their own rules on what is considered taxable or not. Also, these rules can change over time so it's important to keep up to date on all the changes.

Should I use tax software to calculate my taxes?

Tax calculation can be a complicated process and it's easy to overlook important details. Plus, calculating gains/losses from hundreds of crypto transactions can be a daunting task.

Tax software like CoinLedger takes away the majority of the leg work by automating the process for you making it much easier to file and report tax forms.

Comments ()