The China Effect on Blockchains and Cryptocurrencies Future

In the past 3 weeks, news that the Chinese government was cracking down on ICOs and forcing cryptocurrency exchanges to halt trading has sent the markets tanking.

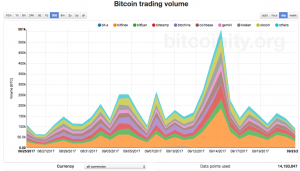

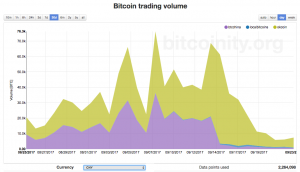

Trading volumes on the cryptocurrency exchanges are down significantly, and the pull-back in activity is not just from the Chinese Yuan and exchanges, but across all currencies and global exchanges. (see the following 2 charts, from http://data.bitcoinity.org/)

We can analyse what we know and don’t know, and give some context to these developments.

First, let us be reminded that Chinese regulators and authorities decisions and policy statements are aimed at the Chinese market. They are not directives for the rest of the world to follow. China’s government scope is at the national level.

Second, the timing of this crackdown may be related to the upcoming 19th National Congress of the Communist Party of China (CPP), scheduled to start on Oct 18th 2017 in Beijing. That is one of the most important meetings in China’s political calendar, and it has been widely reported that the latest announcements are politically motivated muscle-flexing by the CPP.

We know the following:

- Capital flight via cryptocurrency was real, and the Chinese authorities didn’t like that. It wasn’t clear to them where the billions of dollars in crypto gains were going, past the exchanges.

- The KYC/AML practices of Chinese exchanges were not all up to par with the rest of the world. Previously, many exchanges didn’t require stringent KYC, until AML was strictly mandated by the People’s Bank of China in January 2017.

- The ICOmania had reached another dimension in China with over zealous promoters and real scams that took place. Although the pace of ICOs has been strong outside of China, there were hundreds of ICOs inside the country that we didn’t even know about.

So it was expected that some kind of order was overdue. The political coincidence made the moons align more squarely for that perfect storm to take hold.

Despite this turmoil, the global fundamentals behind blockchain, cryptocurrency and ICOs are intact. As much as one would like to think that what China does doesn’t matter, the reality is that when China sneezes at crypto, the rest of the world catches the cold.

For one, Chinese partcipants represent 30–35% of many ICOs, so their absence has been felt, even if the ban doesn’t officially affect non-China ICOs. Some ICOs who had Chinese investors on their radar (via KYC pre-registrations or direct contacts), have experienced a downturn in money raised from that specific region.

Second, the share of Chinese exchanges on total cryptocurrency volumes used to be close to 45–50% before the ban, and now estimated to have dwindled to perhaps about 15%. Some Chinese users can still get away with trading by using VPNs and accessing external exchanges.

With all that backdrop, let us be reminded that China has also previously banned Facebook and Google, but those companies continued to thrive, while China promoted their own versions of these services (Weibo, RenRen, Baidu Tieba). Furthermore, China has its own Twitter (Weibo), YouTube (Youku Tudou), Yelp (Dianping), Tinder (Momo), Apple (Xiaomi), Uber (Didi Kuaidi), PayPal (Alipay), eBay (Taobao), and other home-grown social media giants like WeChat and Tencent QQ.

You get the idea? So, why not expect China to have their own cryptocurrency too, not based on Ethereum or Bitcoin, but based on their own currency, the Chinese Yuan?

That brings me to the next big rumor coming out of China, which is the possibility of issuing their own crypto Yuan. This shouldn’t come as a surprise given that reports that China’s Central Bank has been looking at the digital currency have been around for more than 1.5 years.

What remains unknown is if this current hiccup will affect the Chinese Bitcoin miners supremacy, which stands at about 80–85% of total market share. So far, miners have not been affected, but I am sure they are worried. Several questions arise:

- Will the Chinese government require Bitcoin miners to go through the central switch and have their transactions flagged? That would certainly affect the competitive speeds required for transaction mining.

- Will Chinese miners start to diversify their operations outside of China? One of China’s largest miners, Bitmain has already started activities and shown interest outside of China.

- Will other countries or organizations jump on this opportunity and start to increase their Bitcoin mining capabilities? Some candidates include Russia, Iceland and Canada for countries, and why not the large multinational banks, Amazon or Google for that matter?

Going forward, my predictions on China are:

- China will update their regulation on crypto-exchanges and ICOs after the Party’s convention. Given the current mess, it was easier to wipe the slate clean, and start from that point forward with new rules.

- We will see a Crypto Yuan emerge, but with some peculiar parameters around its creation. It won’t be just like another free floating cryptocurrency, and it may not have all the properties of a cryptocurrency, but maybe only selective ones. Even with some restrictions, that move will be a boon for the crypto-markets, as it will serve to validate the future of cryptocurrencies.

- The Chinese share of Bitcoin mining will decrease. Some of the existing miners might be tempted to mine for the crypto Yuan, unless the government decides to monopolize (or not require) that function. Simultaneously, other parts of the world will pick-up some of the Bitcoin mining activity.

In summary, China wants control, and China will get control. That’s their default modus operandi. Crypto-Tech is no different than the Internet and Web businesses.

What happens in China doesn’t always stay in China anymore. We have not seen the last of that whale’s boat capsizing moves.

[Originally published on Startup Management]

Comments ()